- Growth strategy

- Areas of investment

Our growth strategy

As part of the energy transition, we expect to achieve 4 billion euros of RAB in electricity networks, 3.7 GW of wind and photovoltaic capacity and 5 million customers to 2035.

The extension of concessions will accelerate investments to address network obsolescence.

We will rebalance e-mobility growth around slow and fast charging hubs.

Further expansion of RES portfolio for a greener and more efficient generation mix.

Technological diversification and supply-chain hedging to protect margins.

Channel mix to maximise the quality of acquisitions and reduce churn rate.

Further development of the B2B power segment and integration with PPAs1 strategy.

Areas of investment

Infrastructures: electrification development

An ambitious investment plan to boost electricity networks

The acquisition of electricity distribution networks in the provinces of Milan and Brescia, together with the sale of gas assets in the areas of Brescia, Bergamo, Cremona, Pavia, and Lodi, has allowed us to consolidate our position as a leading national operator and a key driver of the electrification process. Thanks to targeted investments aimed at increasing the network’s capacity and resilience, the Group will reach an electric Regulated Asset Base (RAB) of €4 billion by 2035.

Electricity networks RAB

€B

| RAB accelerated Plan |

CAPEX1

2024-35

EBITDA

@2035

Note:

(1) Includes industrial CAPEX for both the historical perimeter and the assets acquired through the 2024 M&A transaction on electricity networks (does not include M&A)

E-mobility strategy focused on charging hubs to optimise performance

E-mobility remains an essential part of the portfolio, with the target of installing 16,000 charging points by 2035, supported by a growth strategy focused on performance optimisation.

Evolution of charging points

k

CAPEX

2024-35

EBITDA

@2035

Generation: growth and quality of the RES portfolio

Broader and more efficient RES portfolio through repowering and a selective pipeline

Our growth in renewable generation continues, with a targeted development strategy to reach 3.7 GW of wind and solar installed capacity by 2035. The integration of new renewable assets and the modernization of the thermoelectric fleet with high-efficiency assets will further diversify generation mix that already incorporates multiple risk-mitigation levers, including natural hedging thorough the Group’s customer base.

RES capacity

GW

New RES capacity

@2035

CAPEX RES

2024-35

EBITDA RES

@2035

Supply: a new commercial plan

A commercial plan to respond to an increasingly competitive market

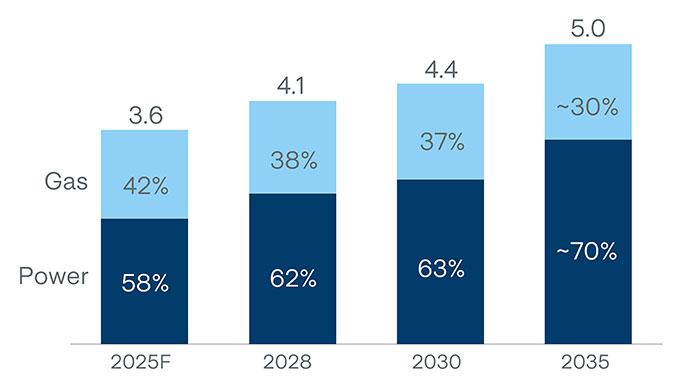

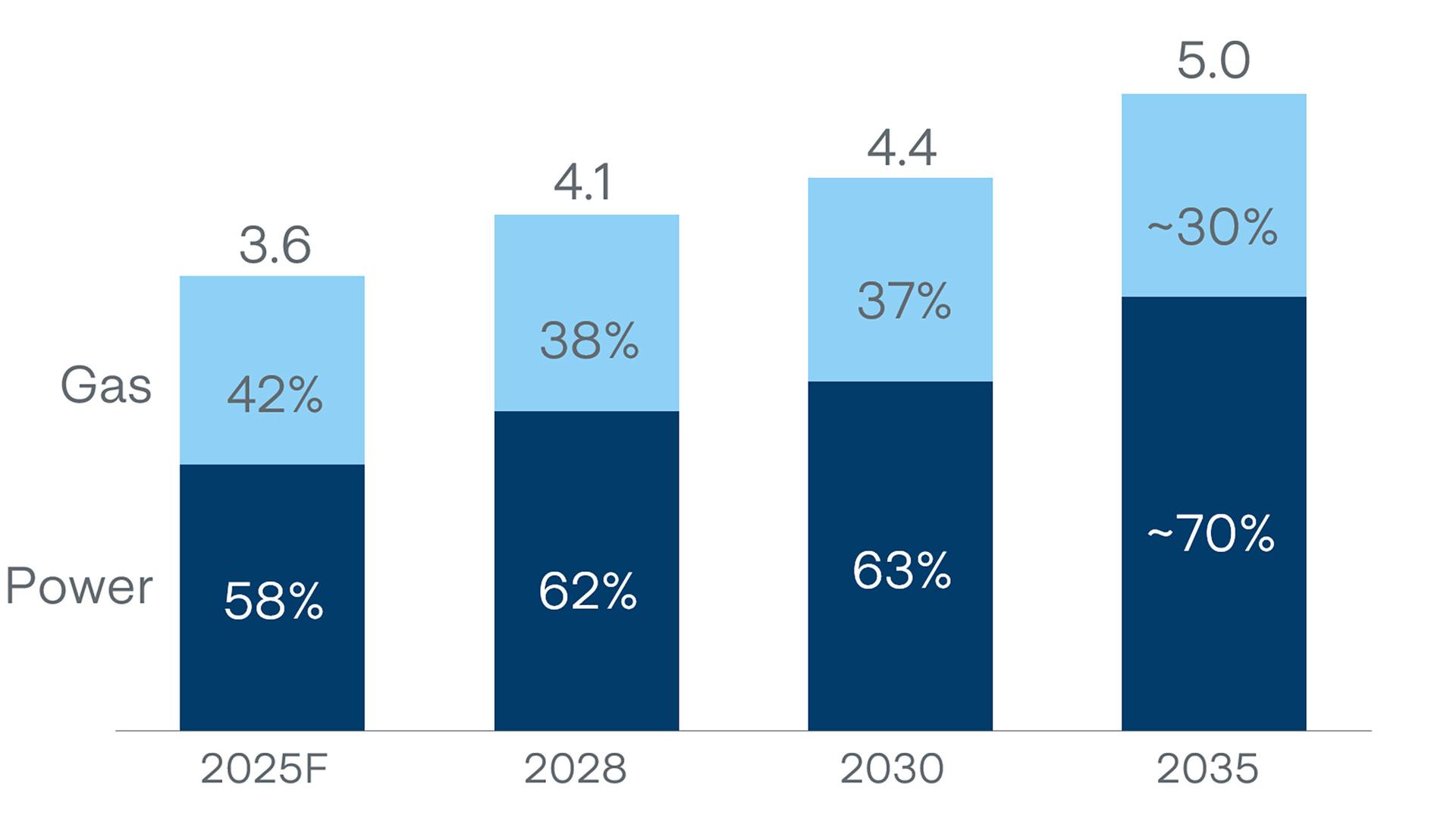

In the Retail segment, in a highly dynamic residential market environment, we confirm our target of 5 million customers by 2035, with around 70% being power customers.

Customer base evolution1

Millions

~1 M customers with mass-market PPAs by 2035

Electricity Customer Base

@2035

EBITDA2 Market

@2035

Notes:

(1) The term “customers” refers to existing contracts;

(2) Data relating to the entire perimeter of the Market BU

Strong positioning in B2B electricity sales, which guarantees us a diversified and solid customer base

In industrial energy supply, with a current market share above 10%, we target further volumes growth supported by PPAs (Power Purchase Agreement) to stabilize margins.

Useful resources

Services

A2A S.p.A. - P.I. 11957540153