2035 targets

Short-term targets confirmed with upside in the medium to long term

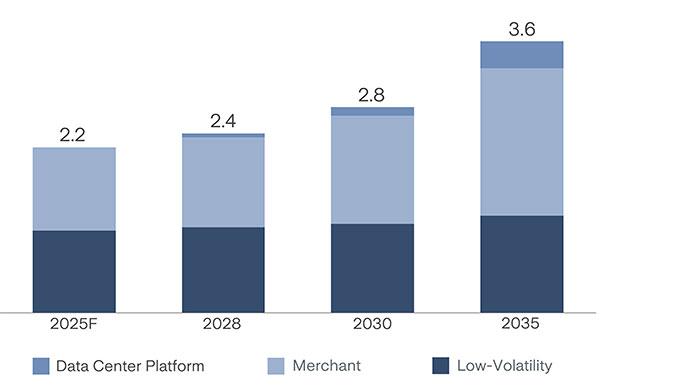

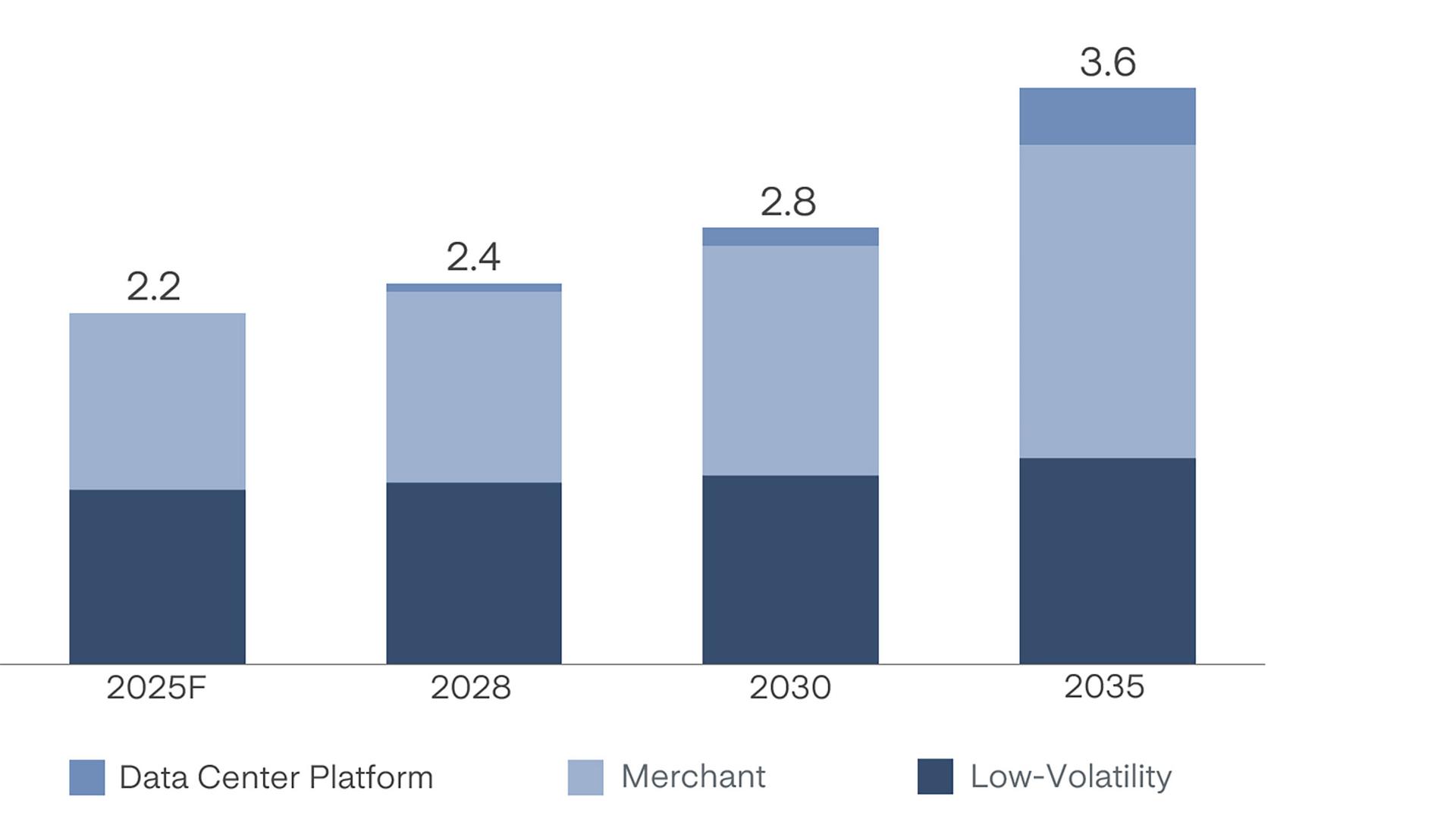

EBITDA

€B

The strategic plan, updated in November 2025, envisages EBITDA to grow from 2.2 €B in 2025F to 2.4 €B in 2028, 2.8 €B in 2030, and 3.6 €B in 2035. This is a CAGR of 5% over 2025-2035 and 6% over 2028-2035.

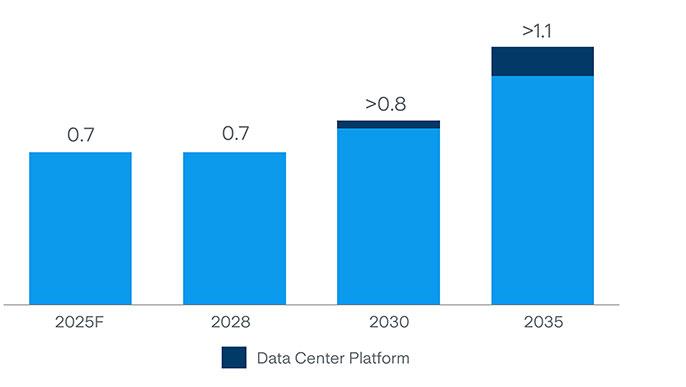

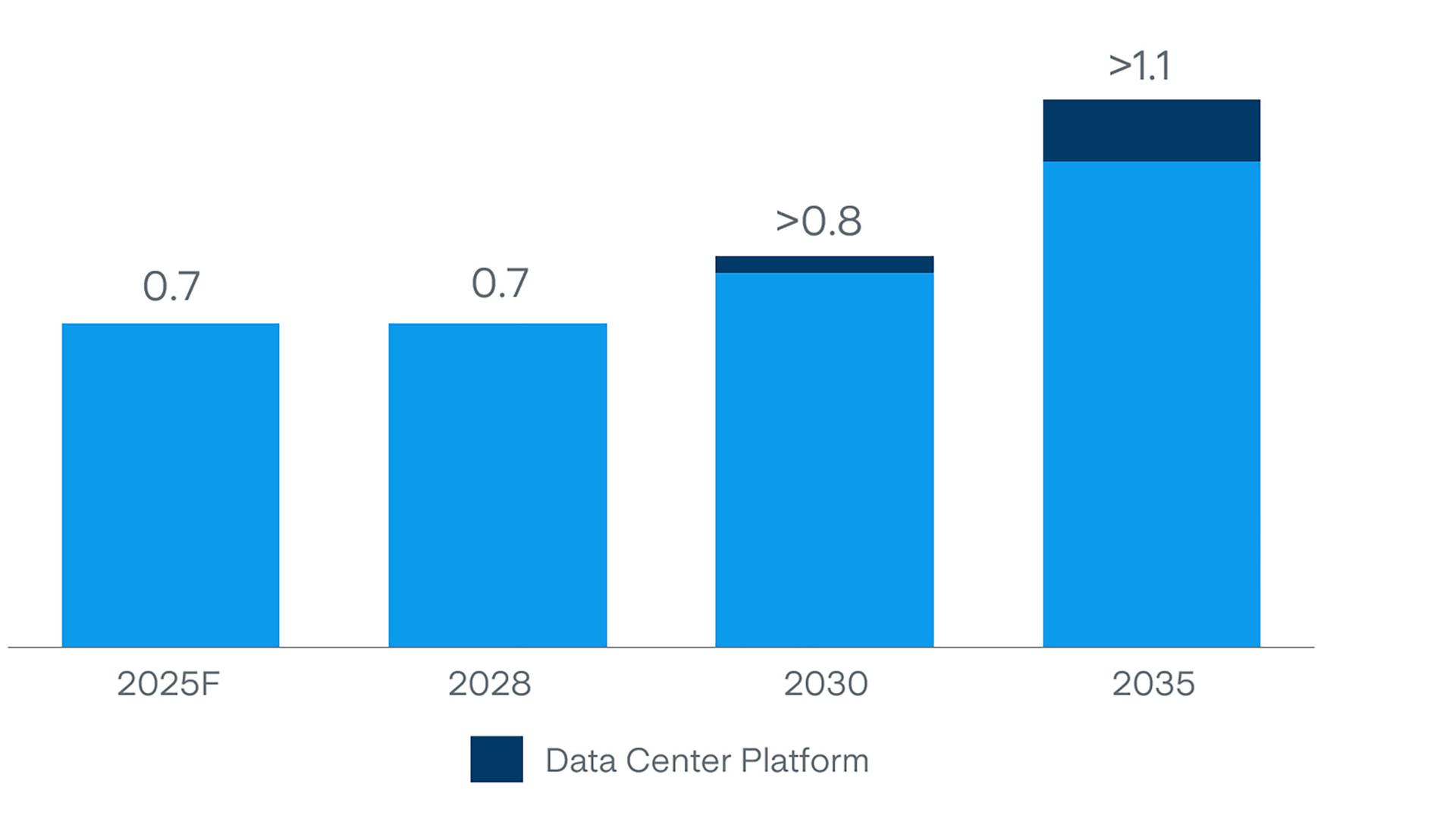

Ordinary Net Income

€B

Ordinary Net Income is expected to reach 0.7€B in 2025F, 0.7 €B in 2028, >0.8 €B in 2030, and >1.1 €B in 2035. This is a CAGR of 6% over 2025-2035 and 8% over 2028-2035.

NFP and debt ratios

| 2024A | 2025F | 2028E | 2030E | 2035E | |

|---|---|---|---|---|---|

| NFP (€B) | 5.8 | 5.5 | 6.6 | 7.4 | 8.7 |

| NFP/EBITDA | 2.5 | 2.5 | 2.8 | 2.7 | 2.4 |

| Cost of debt (%) | 2.7 | 2.7 | 3.0 | 3.2 | 3.3 |

| FFO/Net debt1 (%) | 26.0 | 24.3 | 24.0 | 24.6 | 28.9 |

Note:

(1) methdology based on cash FFO

Return metrics and dividend growth

Return on Investment2 (ROI)

Return on Equity3 (ROE)

DPS growth (annual)

Notes

(2) ROI calculated as EBIT on Net Invested Capital, average 2024F-2035

(3) ROE calculated as Net Income including hybrid coupon / Equity pertaining to the Gruppo, average 2024F-2035

2026 outlook

Business outlook for 2026 Based on the development of industrial projects and considering price trends and market conditions, the A2A Group is expected to achieve in 2026:

- EBITDA between 2.21 and 2.25 billion euro

- Ordinary Net Income of the Group between 0.63 and 0.66 billion euro

Ordinary Net Income of the Group includes the estimate of higher depreciation and amortization resulting from the Purchase Price Allocation process related to the acquisition of 90% of Duereti S.r.l..

EBITDA

Ordinary Net Income

CAPEX

€B

- Cumulative capex 2024-2035: 23 €B

- 45% of capex is dedicated to low volatility projects

- 55% to merchant activities

Capex breakdown

Energy transition

- 4.9 €B electricity networks

- 3.7 €B wind & solar

- 1.6 €B customers

- 1.4 €B flexible energy

- 0.3 €B e-mobility

Circular economy

- 2.8 €B waste treatment

- 1.6 €B data center

- 1.2 €B district heating

- 0.5 €B water cycle

- 0.5 €B waste collection

Cumulative capex by BU (2024-2035)

- 7.6 €B Energy (>15% ROIC)

- 6.5 €B Circular Economy (>10% ROIC)

- 7.4 €B Smart infrastructures (> regulated WACC),

Useful resources

Services

A2A S.p.A. - P.I. 11957540153